Health and Dental benefit costs have increased significantly in recent years. Post pandemic recovery is resulting in cases that are out pacing the flow of contributions to plan funds. General economic conditions, regulatory changes, and ongoing uncertainty pose challenges on negotiating increased contribution rates into plans. Currently it is the patient who is bearing most of the fiscal responsibility. As plans gradually reduce coverages to meet costs, it is the patient who will assume the greater copayment and out of pocket expense. Many of these patients will be unable to pay for these out-of-pocket costs and inevitably will not have the treatment performed. As neglect and abstinence take root, so does failing health and productivity in the workplace, inevitably resulting in the need for extensive treatment to bring the member back to their wellbeing.

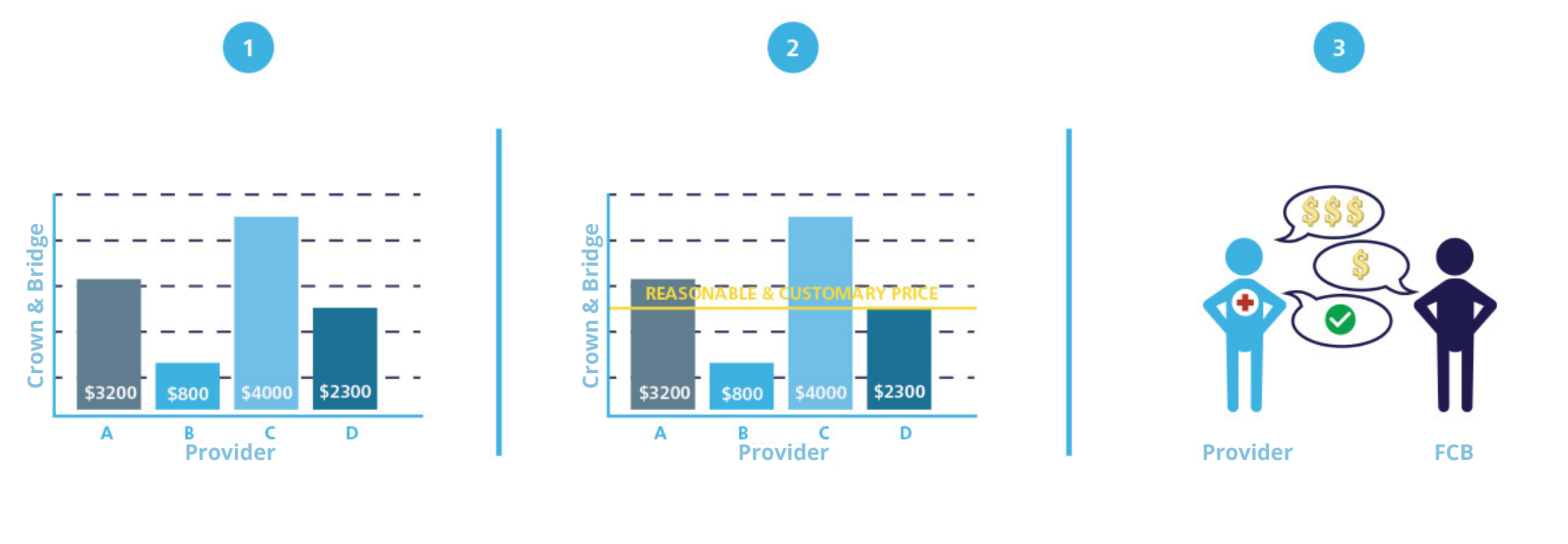

There are in fact severe inequities and disparities in the delivery of health benefits. Technology, increased fee guides, inflation, and rising costs of materials dictates the need for more funds. Payors (Insurers, third party administrators (TPAs), corporations, trusts, organizations, and multi-employer sponsored plans, all referred to as payors) must seek for solutions in an alternative delivery of care model to help sustain and maintain current benefits structures. With our resources and providers, payors can look towards funding these solutions. FCB integrates a contracted health network of providers, under clinical governance, to provide payors both savings and compliance to industry standards. FCB integrates provider services as it offers its proprietary health network under reference-based pricing to payors. Payors savings are between 20-30% on all claims payable.